The $150,000 Question

Your eCommerce business just crossed $100M in annual revenue. Then your CFO drops a bombshell, you’re paying an extra $150,000 per year in platform fees. Not for new features. Not for better performance. Simply for the privilege of growing.

Welcome to the hidden economics of monolithic eCommerce platforms.

For enterprise leaders, Shopify Plus looks like the safe bet, low upfront costs, proven track record, minimal risk. Meanwhile, Composable Commerce appears complex and expensive.

But here’s what the price tags don’t tell you: you’re comparing sticker price to Total Cost of Ownership (TCO). And that gap can cost you millions.

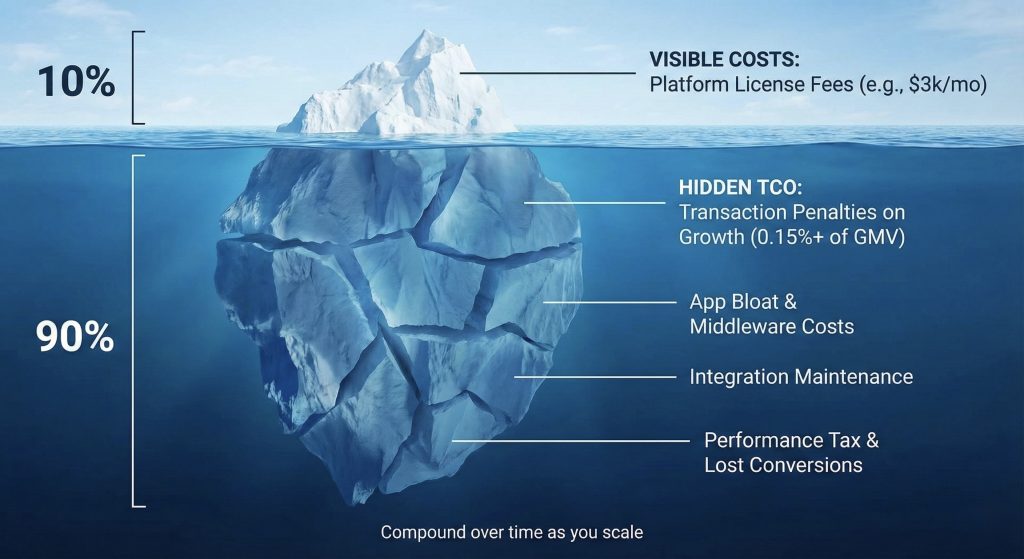

Beyond the Price Tag: Understanding True TCO

Most organizations make a critical mistake when budgeting for eCommerce platforms. They project costs based solely on the platform license fee over a 3-year window.

A complete TCO calculation must account for:

- License and subscription fees (the obvious cost)

- Transaction and payment penalties (the tax on your success)

- Implementation and integration (initial capital expenditure)

- Maintenance and upgrades (ongoing operational expenses)

- Third-party apps and extensions (death by a thousand cuts)

When you factor in all these elements, something surprising happens: Composable (Headless) becomes cheaper than the monolith much earlier than expected often around $30M to $50M in GMV.

The Monolith’s Trap: How Shopify Plus Charges for Your Success

Shopify Plus is exceptional for businesses doing $1M to $20M in annual GMV. But as you scale beyond $20M, the pricing structure reveals its true nature, it’s designed to capture an increasing share of your margin.

If your enterprise needs a different payment gateway than Shopify Payments—say, Adyen for multi-currency optimization or Stripe due to existing banking relationships, Shopify Plus charges an additional transaction fee on top of your gateway’s costs. This penalty typically ranges from 0.15% to 0.25% of every transaction.

On $100M in GMV, that 0.15% penalty equals $150,000 per year straight off your bottom line. As your revenue grows, so does this penalty. It’s a tax on your success.

App Bloat: The $10K Monthly Surprise

Shopify’s core is intentionally lean. To achieve enterprise functionality, sophisticated search, complex returns, loyalty programs, ERP integration, or B2B features you’ll need the App Store. For an enterprise, it’s not uncommon to spend $5,000 to $10,000 monthly on third party applications just to reach feature parity with legacy systems.

This creates compounding problems: You’re managing 20+ separate SaaS contracts with different renewal schedules. Every app adds JavaScript to your frontend, gradually degrading site performance and conversion rates. Your development team spends more time managing dependencies than building competitive advantages.

Shopify is a closed ecosystem. When your business requires a unique feature that Shopify’s APIs don’t natively support, your developers must create expensive workarounds. These customizations are costly to build and even more expensive to maintain. Every Shopify update risks breaking your carefully constructed hacks.

The Composable Alternative: Reversing the Financial Dynamic

Composable Commerce flips the cost structure. You pay upfront for the components, but you don’t pay a penalty for growth.

From Unpredictable Capex to Steady Opex: Traditional platforms like Magento required massive capital expenditure projects every 4-5 years to replatform. Composable Commerce is “versionless”, vendors push updates automatically. The massive, unpredictable capital spikes are replaced by predictable monthly operational expenses.

The Upfront Investment: Let’s be transparent: Building a Composable architecture costs more initially, typically 1.5x to 3x higher than a monolithic implementation. You’re not just configuring a theme; you’re architecting a system, connecting microservices via APIs, and building a custom frontend. This upfront cost is the hurdle that stops most organizations. But it’s an investment in your future operating leverage.

Zero Growth Penalties

Composable commerce engines charge based on API usage or order volume tiers, they almost never charge a percentage of GMV for using third party tools. When you grow from $50M to $100M in GMV, your commerce engine costs might increase incrementally. But you won’t pay an extra $75,000 in transaction penalties. You keep your margin.

Best-of-Breed Flexibility

In a monolithic system, you pay for the entire suite even if you only use 40% of its features. The composable approach lets you select best-of-breed components based on actual needs. You optimize spending based on utility, not bundled features you’ll never use.

The Inflection Point: Running the Numbers

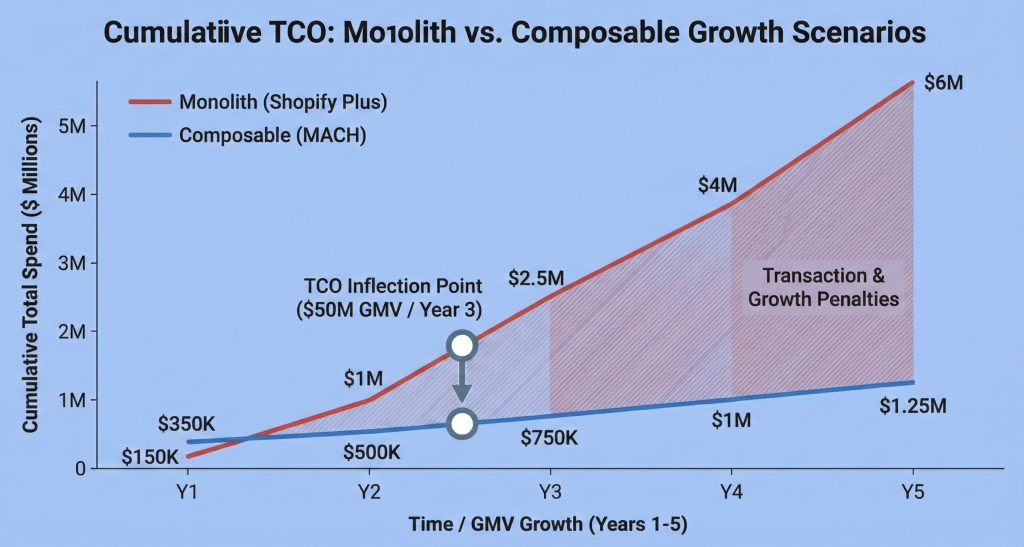

Let’s examine a 3-year TCO comparison for a growing enterprise.

Scenario: A business with $50M GMV in Year 1, growing 20% annually, using an external payment gateway.

3-Year TCO Breakdown

| Cost Category | Shopify Plus | Composable (MACH) | Analysis |

|---|---|---|---|

| Initial Build (Capex) | $150,000 | $350,000 | Composable requires higher upfront investment |

| Licensing Fees | $108,000 | $252,000 | Composable components have higher base costs |

| Transaction Penalty (0.15%) | $273,000 | $0 | The critical differentiator |

| 3rd Party Apps/Services | $216,000 | $108,000 | Shopify requires more apps for enterprise functionality |

| Maintenance/Upgrades | $75,000 | $100,000 | Comparable costs, different focus areas |

| 3-Year Estimated TCO | $822,000 | $810,000 | Break-even at 3 years |

The Insight

Even with a build cost more than double the monolithic approach, Composable TCO breaks even with Shopify Plus around the 3-year mark. If your company grows faster than 20% annually, or starts with higher GMV, Composable becomes significantly cheaper much sooner. That transaction penalty line item on the Shopify side balloons with every dollar of growth.

Making the Right Choice

Shopify Plus operates like a low-interest loan that gradually develops a very high variable interest rate as you scale. It’s excellent for getting started quickly, but expensive at high-volume maturity.

Composable Commerce requires a larger down payment but offers a fixed rate mortgage you can leverage as you grow. Your technology costs don’t scale linearly with revenue.

If your organization plans to remain under $30M in GMV with straightforward requirements, the monolith may be the right financial choice. But if your roadmap includes aggressive growth, international expansion, or complex omnichannel requirements, the monolith’s TCO will eventually drag on your margins.

Moving to composable is an investment in operating leverage. It ensures that as your revenue scales up, your technology costs don’t scale proportionally with it. The question isn’t which platform is cheaper today. The question is: which platform positions you to capture more value tomorrow?

Pingback: Gartner Magic Quadrant for Digital Commerce 2024-2025: Critical Analysis