Executive Summary

From growth at any cost to profitability at scale

India’s digital commerce ecosystem has reached an inflection point in 2026, with the market crossing $95 billion in gross merchandise value (GMV) and demonstrating fundamental structural shifts that distinguish this phase from previous growth cycles. This white paper examines the convergence of technology maturation, regulatory evolution, and consumer behavioural changes that are reshaping Indian eCommerce from an experimental channel into the primary retail infrastructure for the country’s digital economy.

Key Findings

- The Indian eCommerce market reached $95 billion in GMV in 2026, growing at 21% year-over-year (Bain & Company, 2026), with quick commerce emerging as the fastest-growing segment at 68% annual growth (RedSeer, December 2025).

- Tier 2+ cities now account for 47% of online buyers, up from 38% in 2024 (IAMAI Digital India 2025), driven by vernacular interfaces, improved logistics infrastructure, and localized payment solutions.

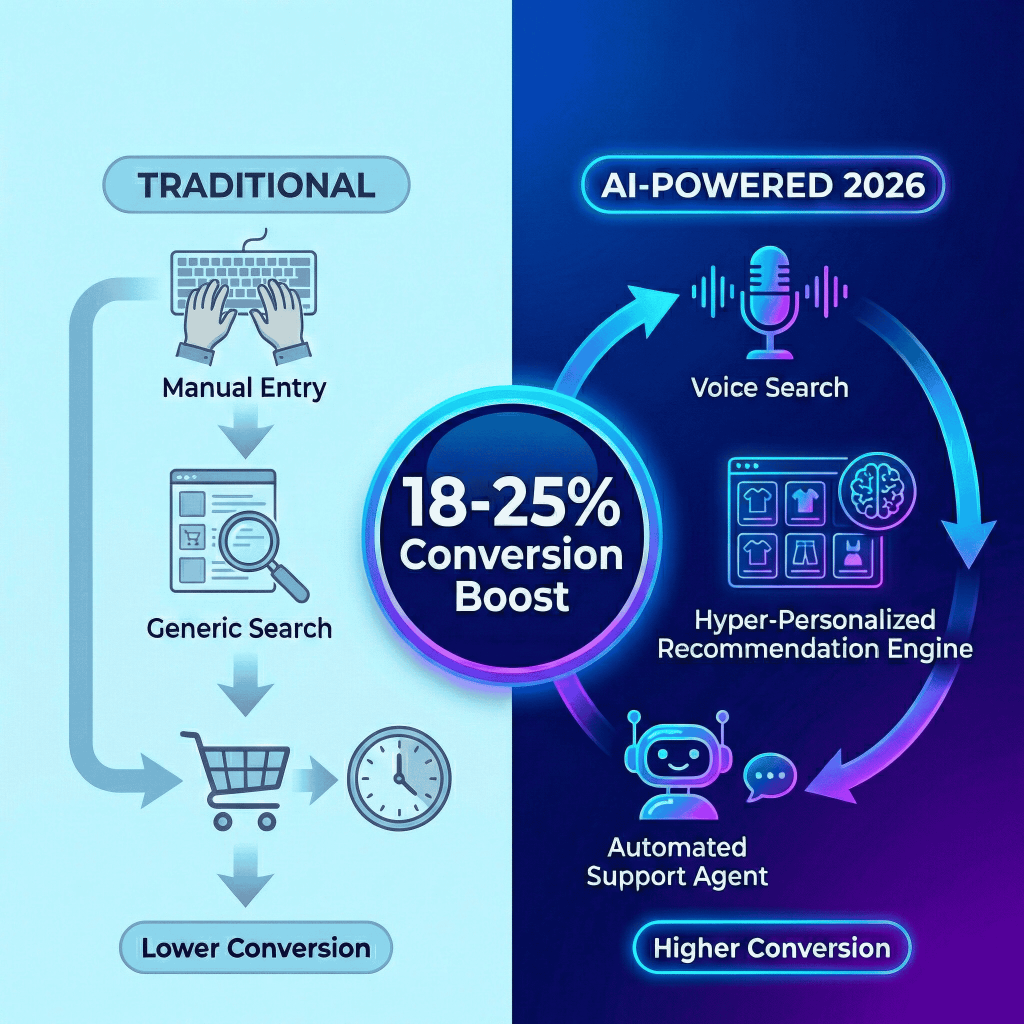

- AI-powered personalization has driven conversion rate improvements of 18-25% across major platforms (industry benchmarks), with conversational commerce via WhatsApp and Instagram capturing 12% of D2C transactions (Redseer, 2025).

- The Open Network for Digital Commerce (ONDC) has facilitated over $4.2 billion in transactions (Ministry of Commerce & Industry, Q4 2025), demonstrating viability as alternative infrastructure while major marketplaces maintain 78% market share (Bain & Company, 2026).

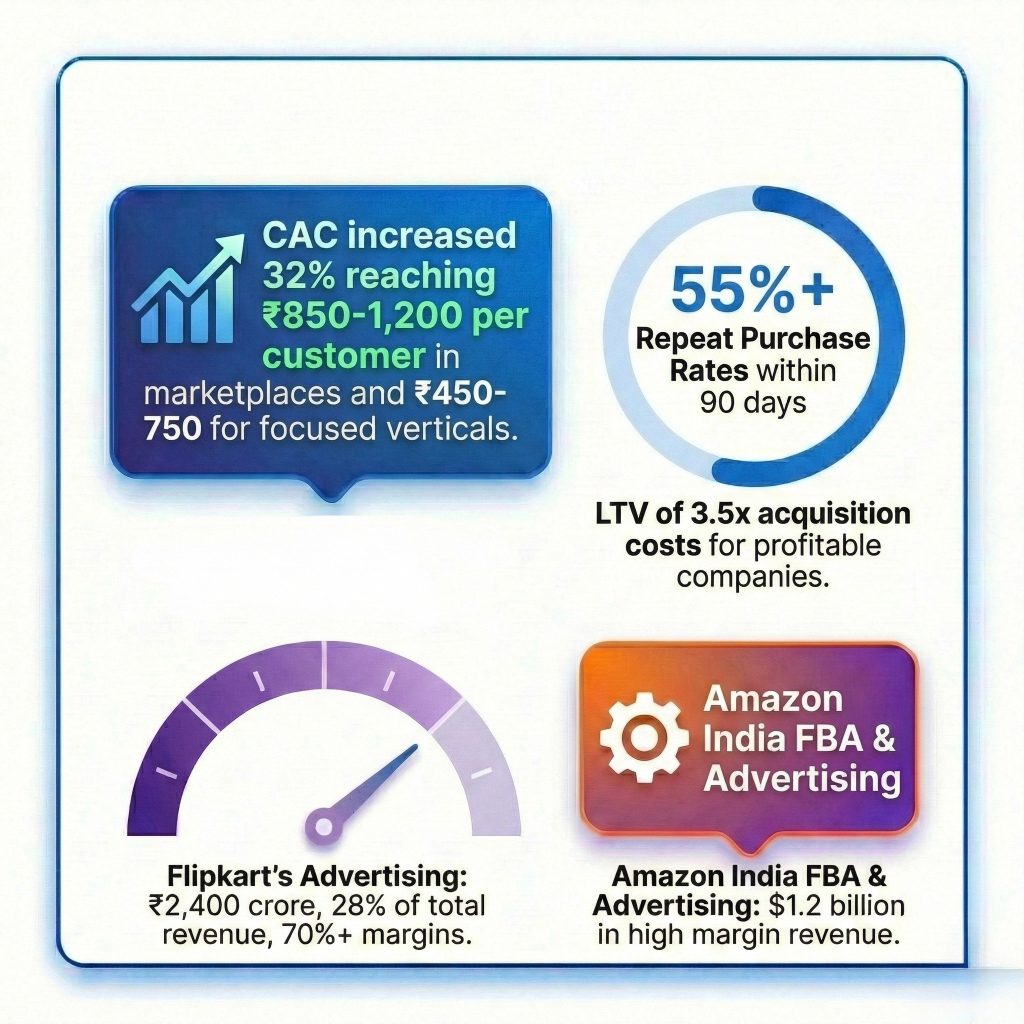

- Customer acquisition costs have risen 32% since 2024 (industry analysis), forcing strategic shifts toward retention economics, with profitable brands demonstrating 55%+ repeat purchase rates.

The Five Forces Reshaping Indian eCommerce

Technology Democratization: AI capabilities previously exclusive to large platforms are now accessible to mid-sized brands through SaaS tools, enabling sophisticated personalization, dynamic pricing, and customer service automation at scale.

Infrastructure Unbundling: ONDC and modular commerce stacks are decoupling discovery, transactions, and fulfilment, creating opportunities for specialized players while challenging integrated marketplace models.

Hyperlocal Maturation: Quick commerce has evolved from urban food delivery into a comprehensive 15-30 minute fulfilment model spanning groceries, fashion, electronics, and services across 45+ cities.

Consumer Sophistication: Indian digital consumers increasingly prioritize experience quality over mere price arbitrage, with 63% willing to pay premiums for faster delivery, better service, and sustainable practices (Redseer Consumer Study, 2025).

Regulatory Codification: The maturation of data protection frameworks, consumer rights legislation, and platform governance norms is creating clearer operational parameters while increasing compliance costs.

India’s Digital Commerce Landscape: 2026 Baseline

Market Size and Category Distribution

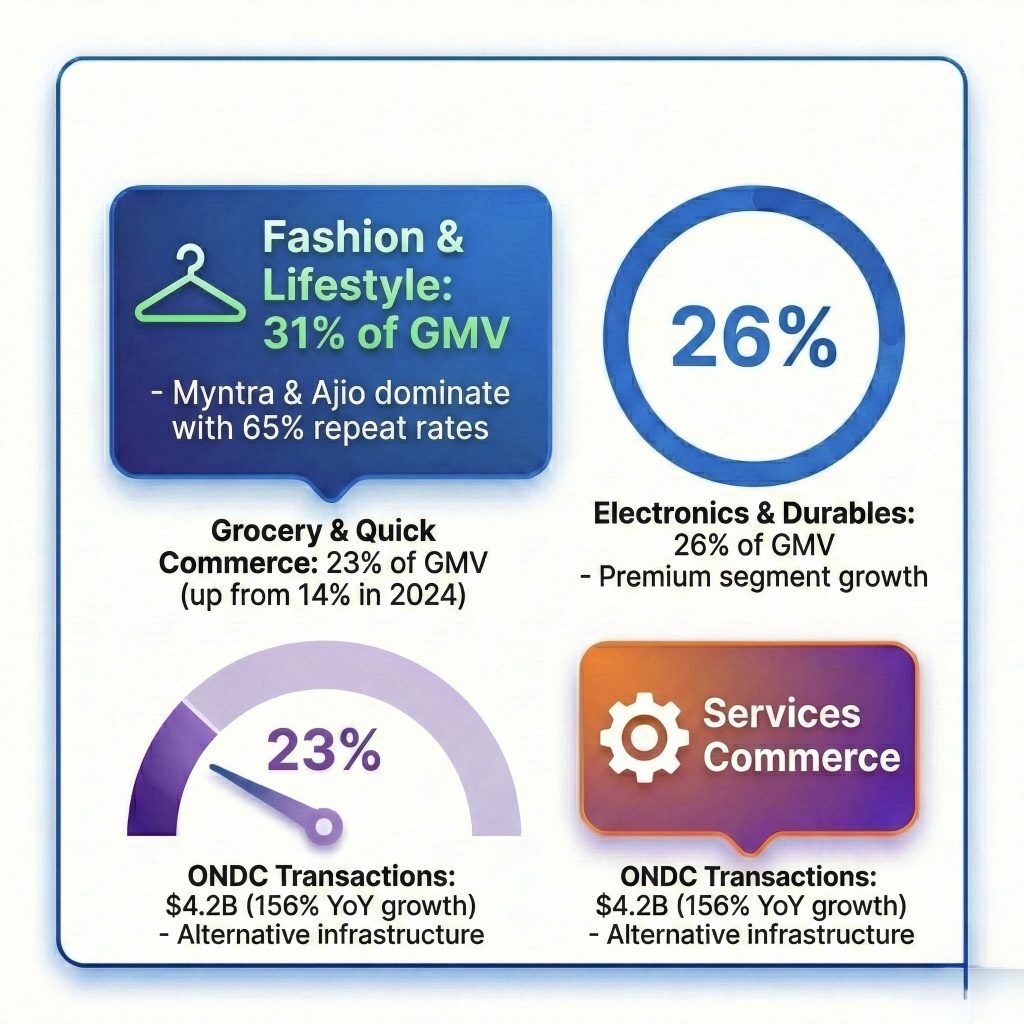

The Indian eCommerce market reached $95 billion in GMV in 2026, representing 9.8% of total retail sales (Bain & Company, January 2026). This penetration rate, while growing rapidly, indicates substantial headroom compared to China (52%) and the United States (16%), suggesting India’s digital commerce trajectory remains in expansion phase rather than maturity.

Category composition has diversified significantly, with grocery and quick commerce now representing 23% of total eCommerce GMV, up from 14% in 2024 (RedSeer Category Analysis, 2025). Fashion and lifestyle maintain the largest share at 31%, followed by electronics and durables at 26%. The emergence of service based commerce, including education, healthcare consultations, and professional services, now accounts for 8% of digital transactions, a category virtually non-existent three years prior.

Geographic Penetration and the Tier 2+ Opportunity

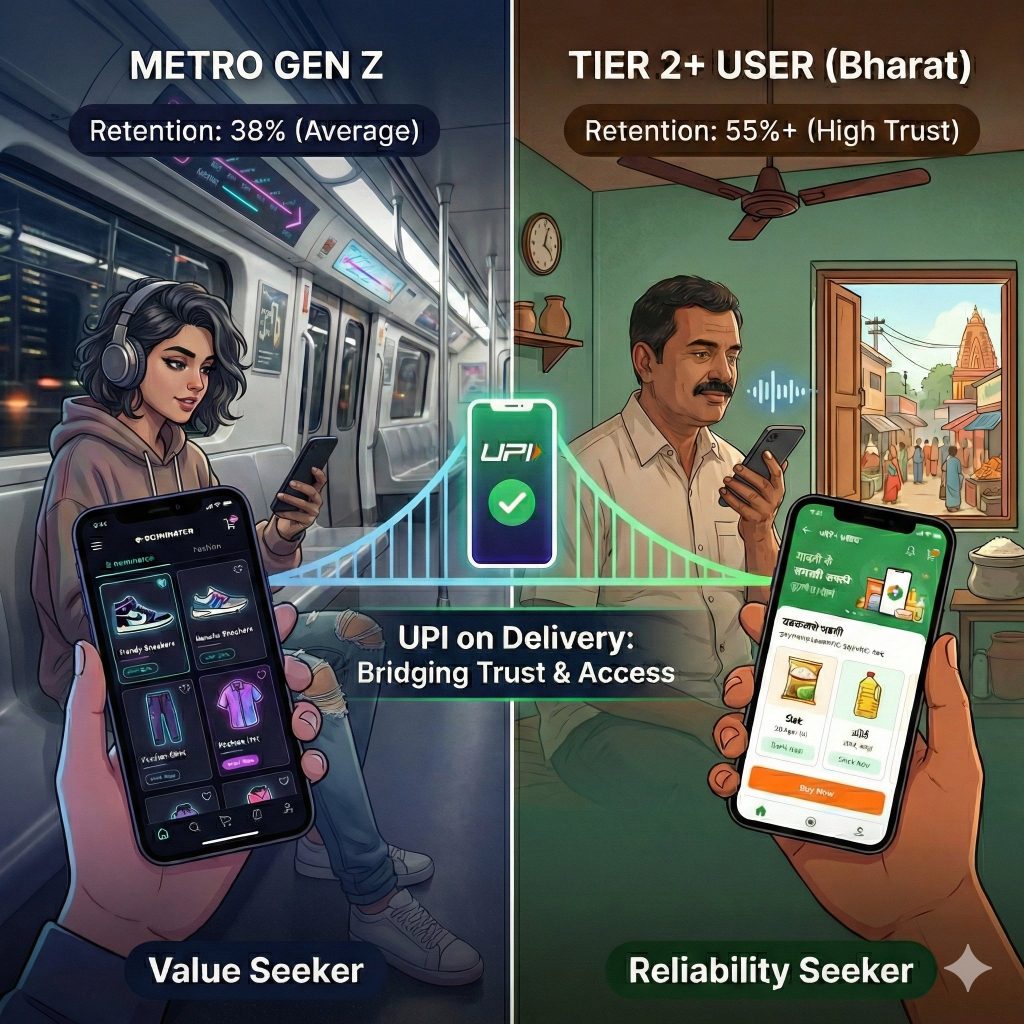

The geographic expansion of digital commerce represents perhaps the most significant structural shift in the Indian market. Tier 2 and 3 cities contributed 47% of new eCommerce users in 2025-26 (IAMAI, 2025), driven by improved logistics infrastructure reaching 95% postal code coverage (industry data), vernacular interface adoption across all major platforms, and the proliferation of cash-on-delivery alternatives including UPI-on-delivery and assisted digital payment models.

Average order values in Tier 2+ cities have converged toward metro averages, now at 83% of urban AOV compared to 68% in 2024 (Redseer, 2025), indicating increasing purchasing power and product category expansion. Significantly, retention rates in these markets exceed metro rates by 7-9 percentage points, suggesting that initial skepticism converts into strong loyalty once trust is established through successful initial transactions.

Platform Dynamics: Concentration and Fragmentation

The Indian eCommerce landscape exhibits simultaneous concentration and fragmentation dynamics. Amazon India, Flipkart, and Meesho collectively command 78% of overall GMV (Bain & Company, 2026), maintaining dominance through network effects, logistics infrastructure, and customer acquisition advantages. However, vertical specialization and D2C brands have captured 18% market share in 2026, up from 11% in 2024, indicating growing consumer comfort with non-marketplace purchasing.

ONDC has emerged as credible alternative infrastructure, facilitating $4.2 billion in transactions across 285 participating platforms (Ministry of Commerce, Q4 2025). While representing only 4.4% of total eCommerce GMV, ONDC’s growth rate of 156% year-over-year and its role in enabling smaller merchants and regional players suggests its strategic importance exceeds current transaction volumes.

The Indian Digital Consumer in 2026

Emerging Buyer Cohorts

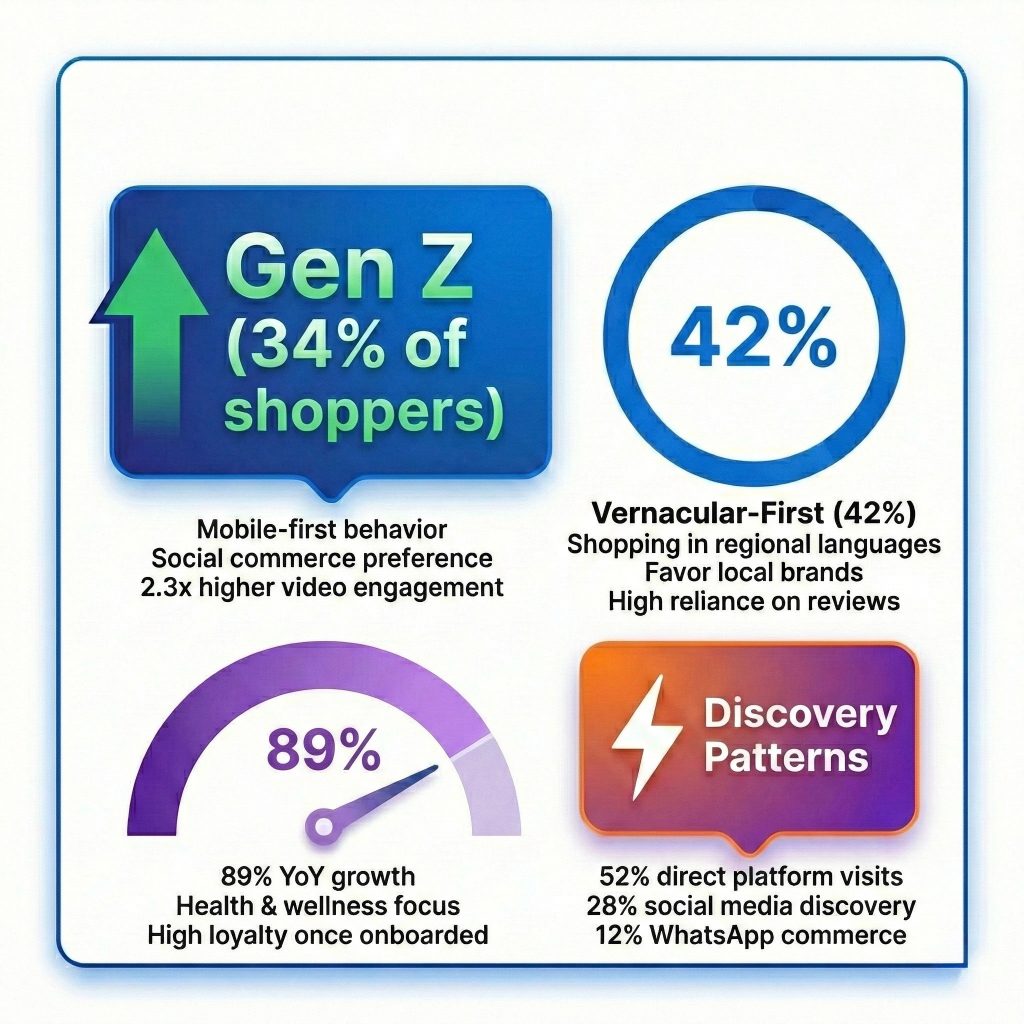

Three distinct cohorts are reshaping Indian eCommerce demographics. Gen Z buyers (ages 18-26) now represent 34% of active online shoppers (Redseer Consumer Behaviour Study, 2025), distinguished by mobile-first behaviour, social commerce preference, and expectation of personalized experiences. This cohort demonstrates 2.3x higher engagement with short-form video content and influencer recommendations compared to older demographics.

Vernacular-first users, predominantly shopping in Hindi, Tamil, Telugu, and Bengali interfaces, have grown to 42% of total users (IAMAI, 2025). This segment exhibits distinct product preferences, favouring local brands, value-oriented purchasing, and higher reliance on customer reviews and social proof. Conversion optimization for this cohort requires language-specific content strategies rather than mere translation.

Senior online shoppers (55+ years) represent the fastest-growing demographic by percentage, increasing 89% year-over-year (industry estimates). This cohort concentrates in health, wellness, and essential categories, values customer service accessibility, and demonstrates high loyalty once comfortable with platforms, though requiring more extensive onboarding support.

Discovery and Purchase Behaviour

Consumer discovery patterns have fragmented across multiple touchpoints. While 52% of purchases still originate from direct platform visits or apps, social media discovery has captured 28% of customer journeys (Redseer, 2025), with Instagram and YouTube serving as primary product research channels. AI-powered search and recommendations drive 31% of purchases on major platforms, while creator and influencer attribution accounts for 16% of D2C brand acquisitions.

Voice and conversational commerce via WhatsApp has reached inflection point, with 12% of D2C transactions occurring through chat-based interfaces (Redseer, 2025). This channel demonstrates particularly strong performance for repeat purchases, customer service resolution, and personalized recommendations, with conversion rates 2.1x higher than traditional web funnels for engaged users.Here

Here is How Generative AI is Reshaping Consumer Behavior

Payment Evolution and Financial Inclusion

UPI’s dominance in digital payments has reached 73% of eCommerce transactions (NPCI, Q4 2025), with wallets and cards declining to 19% and 8% respectively. The critical evolution in 2026 is not payment method but payment timing, with Buy Now Pay Later (BNPL) and embedded credit lines now utilized in 24% of transactions (RBI Digital Payments Report, 2025), enabling affordability driven purchasing for products previously considered premium.

Post-purchase payment options, including UPI-on-delivery and pay-after-trial models, have addressed trust barriers in Tier 2+ markets, growing to 18% of transactions in these geographies (industry data). These hybrid payment models combine the trust-building aspect of cash-on-delivery with the efficiency of digital payments.

Category Deep Dive: Structural Shifts

Grocery and Quick Commerce: The Paradigm Shift

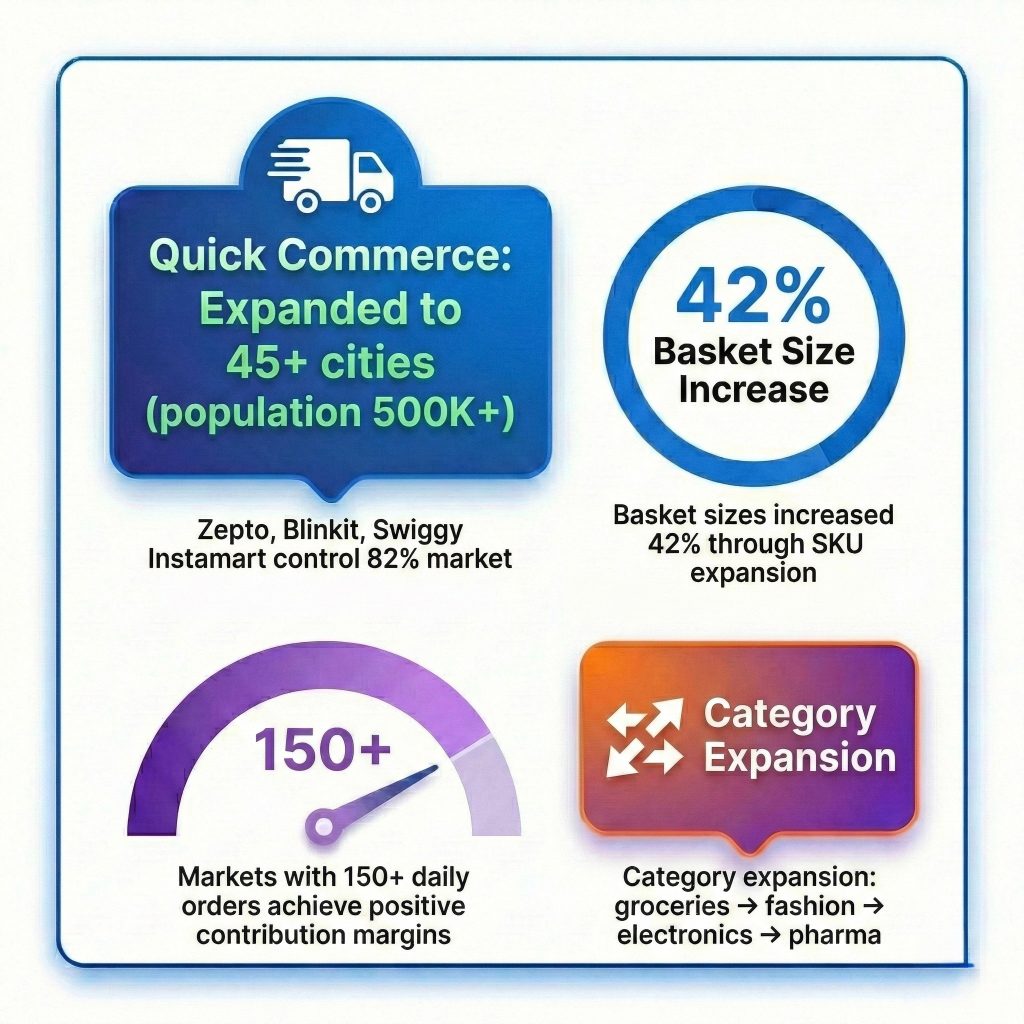

Quick commerce has evolved from niche urban convenience into mainstream retail infrastructure, processing $21.8 billion in GMV in 2026 with 68% annual growth (RedSeer Quick Commerce Report, December 2025). The model’s expansion beyond tier-1 cities into 45 metros, covering populations above 500,000, demonstrates operational scalability previously questioned by analysts.

Blinkit (formerly Grofers), Zepto, and Swiggy Instamart have emerged as the dominant triumvirate, collectively capturing 82% of the quick commerce market. Blinkit’s integration with Zomato has proven particularly effective, leveraging existing dark store infrastructure and delivery networks to achieve 175+ orders per store daily in mature markets. Zepto’s focus on premium neighbourhoods and expanded SKU range has enabled it to maintain 42% year-over-year growth despite increasing competition.

The critical insight is that quick commerce profitability follows demand density thresholds rather than unit economics in isolation. Markets achieving 150+ orders per dark store daily demonstrate positive contribution margins (industry benchmarks), with leading players reaching this threshold in 32 cities. Category expansion beyond groceries into fashion, electronics, and pharmaceutical products has increased basket sizes by 42%, fundamentally altering the economic model.

Fashion and Lifestyle: Digital-First Dominance

Fashion and lifestyle categories maintain leadership in Indian eCommerce with $29.5 billion in GMV (Bain & Company, 2026). Myntra and Ajio have solidified positions as specialized fashion destinations, with Myntra processing over 450 million annual orders and maintaining 65% repeat purchase rates through personalized styling recommendations and exclusive brand partnerships.

The emergence of social commerce has particularly disrupted fashion categories. Meesho’s user-generated reseller network has captured significant market share in Tier 2+ cities, with fashion representing 48% of its GMV. The platform’s success demonstrates that trust-based, community-driven commerce can overcome traditional barriers in price-sensitive segments.

D2C Brands: From Experiment to Establishment

Direct-to-consumer brands have matured beyond venture-funded growth-at-all-costs models into sustainable businesses demonstrating path to profitability. The D2C sector collectively reached $17.1 billion in 2026 (Bain & Company, 2026), with successful brands exhibiting 55-65% repeat purchase rates and contribution margins exceeding 30%.

The most significant shift is distribution strategy evolution. Leading D2C brands now operate hybrid models, combining owned channels (representing 45-60% of revenue) with selective marketplace presence and offline retail partnerships. This omnichannel approach addresses customer acquisition cost pressures while maintaining brand control and direct customer relationships.

Strategic Wins: Brands That Thrived in 2025

Quick Commerce Consolidators

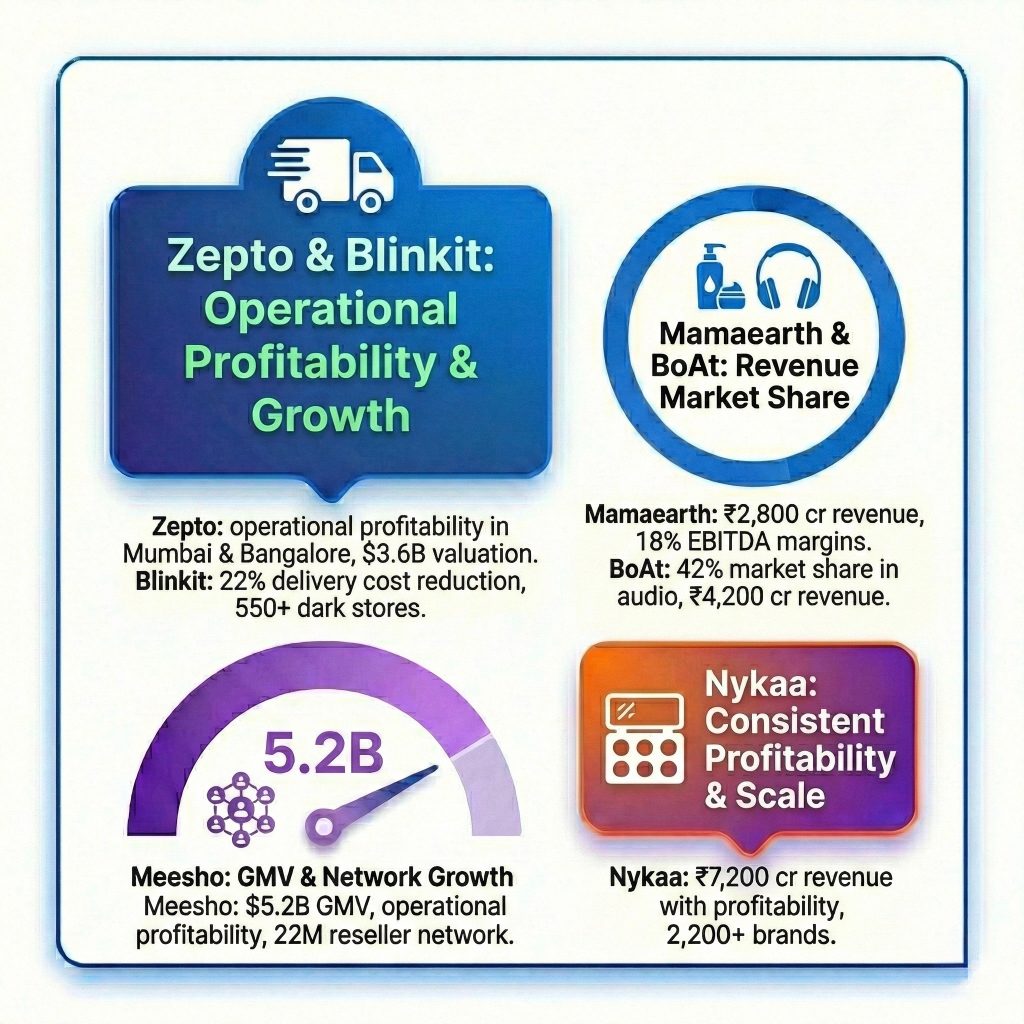

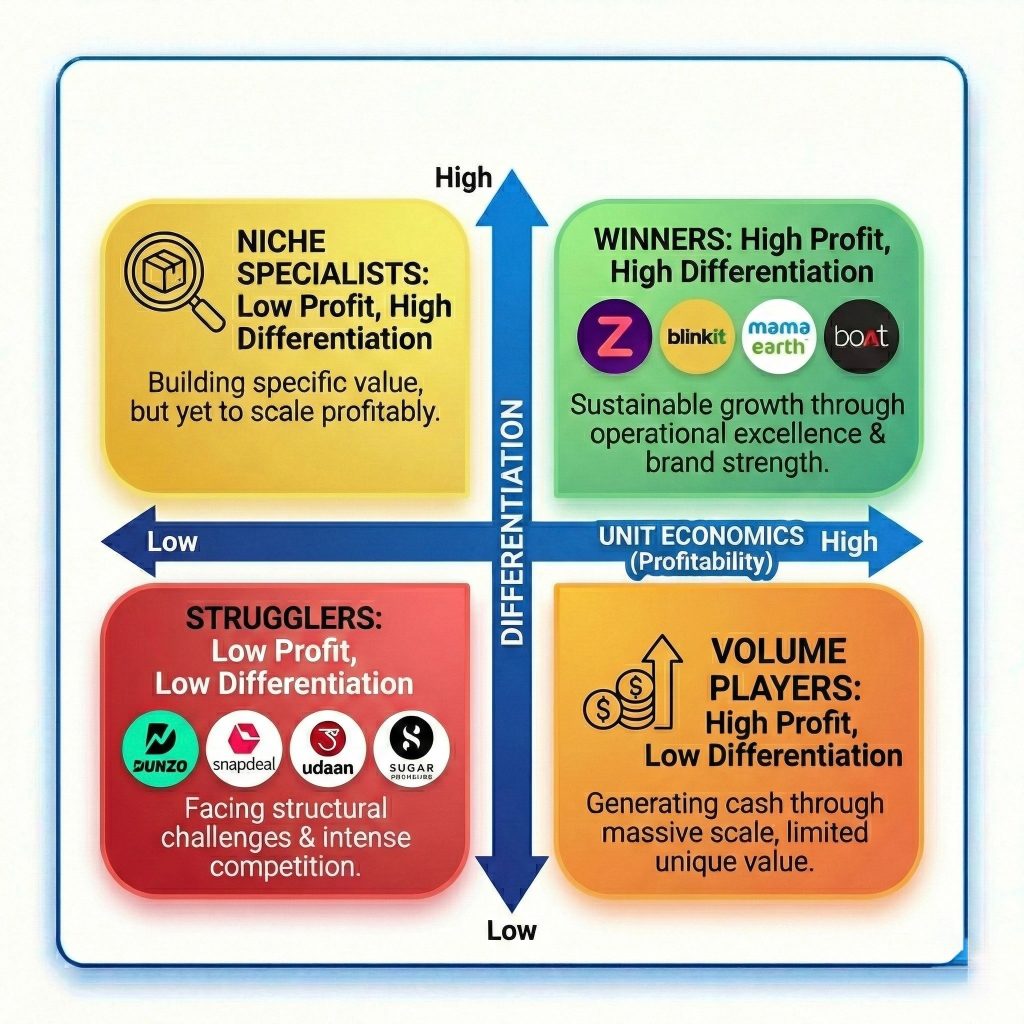

Zepto: The Mumbai-based quick commerce startup executed a masterclass in operational excellence and market positioning. By focusing on premium urban neighbourhoods with high-density apartment complexes, Zepto achieved average order values of ₹650, significantly above the category average of ₹420. The company’s strategic decision to expand SKU count from 2,500 to 8,500 items enabled cross-category purchasing, with 38% of orders containing products from three or more categories. Zepto’s dark store utilization reached 92%, with average order processing times of 2.8 minutes. The brand achieved operational profitability in Mumbai and Bangalore by Q3 2025, validating its premium positioning strategy. Zepto’s $200 million Series F round at a $3.6 billion valuation in late 2025 reflected investor confidence in sustainable unit economics.

Blinkit: Zomato’s acquisition of Blinkit (formerly Grofers) in 2022 proved prescient by 2026. The integration of Blinkit’s dark store network with Zomato’s delivery fleet created operational synergies that reduced per-order delivery costs by 22%. Blinkit leveraged Zomato’s 15+ million monthly active users for cross-platform promotion, achieving customer acquisition costs 45% below standalone quick commerce competitors. The platform expanded to 550+ dark stores across 28 cities, processing 12 million monthly orders by December 2025. Blinkit’s strategic focus on everyday essentials combined with impulse categories (snacks, beverages, personal care) drove basket size increases while maintaining inventory turnover of 18 days. The brand reported contribution margin positivity across top 12 cities, positioning Zomato’s commerce division for profitability by FY 2027.

D2C Success Stories

Mamaearth (Honasa Consumer): The personal care D2C brand’s journey to profitability and successful IPO in 2023 continued its upward trajectory in 2026. Mamaearth achieved ₹2,800 crore in revenue with 18% EBITDA margins, demonstrating that D2C brands can scale profitably. The company’s omnichannel strategy proved decisive: while online channels (owned website plus marketplaces) contributed 62% of revenue, offline expansion through 40,000+ retail touchpoints provided credibility and trial opportunities in Tier 2/3 cities. Mamaearth’s investment in manufacturing infrastructure reduced dependency on third-party manufacturers to 35%, improving gross margins from 58% to 67%. The brand’s portfolio expansion into men’s grooming (The Derma Co.) and color cosmetics (BBlunt) enabled cross-selling, with 34% of customers purchasing across brand portfolios. Customer retention rates reached 58%, with repeat buyers contributing 72% of revenue.

BoAt (Imagine Marketing): India’s leading audio wearables brand maintained market leadership despite intensifying competition from Chinese and Korean manufacturers. BoAt’s 2026 revenue crossed ₹4,200 crore with 42% market share in wireless earbuds and smartwatches. The brand’s success stemmed from ruthless focus on distribution breadth combined with aggressive pricing. BoAt products were available across 35,000+ retail outlets and all major eCommerce platforms, ensuring ubiquitous presence. The company’s strategy of launching 45+ SKUs annually created perception of innovation while enabling price-point coverage from ₹999 to ₹9,999. BoAt’s influencer marketing program, partnering with 200+ content creators, generated authentic product reviews that resonated with Gen Z buyers. The brand’s strategic decision to invest in after-sales service infrastructure (125 service centres nationwide) addressed the category’s primary pain point, reducing return rates from 8.2% to 4.7%. BoAt’s IPO preparations for 2027 valued the company at $1.4-1.6 billion.

Lenskart: The eyewear brand’s omnichannel model reached maturity in 2026, with 1,200+ retail stores complementing its online presence. Lenskart’s revenue crossed ₹5,500 crore, with 52% originating from online channels. The company’s strategic moats included vertical integration (manufacturing 60% of frames in-house), AI-powered home eye testing, and 3D try-on technology that reduced product returns to 3.2%. Lenskart’s subscription model (Gold membership) achieved 2.8 million subscribers, generating predictable recurring revenue while improving customer lifetime value to ₹12,400. The brand’s expansion into sunglasses and contact lenses diversified revenue streams beyond prescription eyewear. Lenskart’s international expansion into Southeast Asia and Middle East contributed 18% of revenue, demonstrating scalability of its model beyond India.

Platform Innovation Leaders

Meesho: The social commerce platform achieved breakthrough success in 2026, processing $5.2 billion in GMV while reaching operational profitability. Meesho’s differentiated strategy focused on serving Tier 2+ cities through a zero-commission model for sellers and vernacular interface prioritization. The platform’s reseller network grew to 22 million entrepreneurs, predominantly women, who leveraged social networks (WhatsApp, Facebook) for product distribution. Meesho’s logistics costs, 30% below marketplace averages due to optimized routing and regional fulfilment centres, enabled competitive pricing without sacrificing seller economics. The platform’s average order value of ₹380 appeared lower than competitors, but basket frequency of 4.2 orders per user annually drove strong customer lifetime value. Meesho’s focus on unbranded and value fashion categories resonated with price-conscious consumers, capturing 34% market share in the ₹200-₹500 fashion segment. The company’s $850 million Series G funding at $7.8 billion valuation validated its thesis that the next 100 million eCommerce users require fundamentally different approach than the first 100 million.

Nykaa: The beauty and personal care specialist maintained category leadership with ₹7,200 crore revenue and consistent profitability. Nykaa’s competitive advantages included curated brand selection (2,200+ brands), authentic product guarantee addressing widespread counterfeiting concerns, and beauty advisor services (online and in 125 retail stores). The platform’s private label brands (Kay Beauty, Nykaa Cosmetics, Nykaa Naturals) contributed 28% of GMV with significantly higher margins. Nykaa’s content strategy, featuring tutorials, influencer collaborations, and livestream shopping events, drove 42% of customer acquisitions organically. The company’s expansion into fashion through Nykaa Fashion showed early traction, reaching ₹1,100 crore in GMV, though profitability remained elusive in this category. Nykaa’s male customer base grew to 32%, driven by men’s grooming category growth and strategic marketing campaigns. The brand’s omnichannel presence, combining online convenience with experiential retail stores, created sustainable competitive moat in the premiumization-focused beauty market.

Strategic Misses: Brands That Struggled

Quick Commerce Casualties

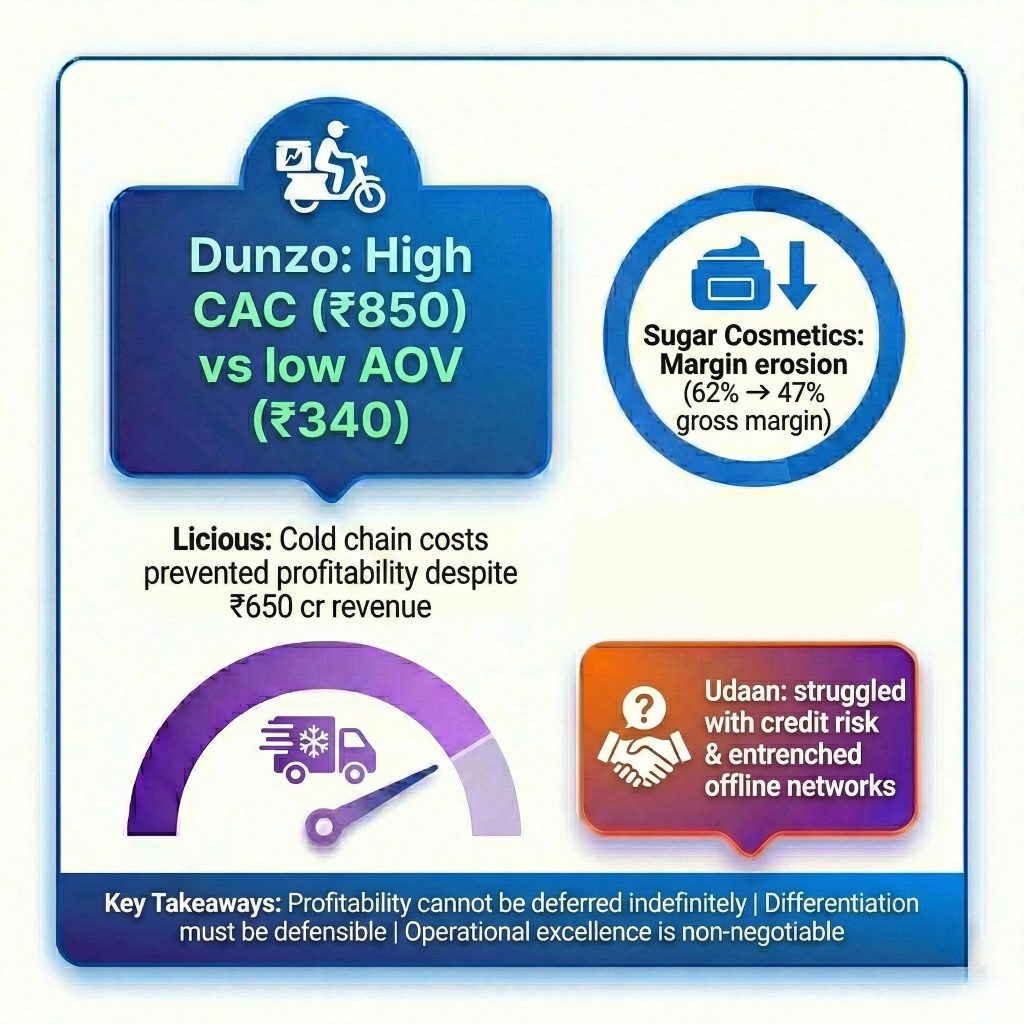

Dunzo: Once valued at $775 million, Dunzo’s decline represents a cautionary tale of premature scaling without unit economics validation. The company’s attempt to compete simultaneously in hyperlocal delivery, quick commerce, and B2B supply chain stretched capital and management bandwidth beyond breaking point. Dunzo’s dark store economics never achieved profitability, with average orders per store stagnating at 65-80 daily, well below the 150+ threshold required for contribution margin positivity. The company’s inability to raise follow-on funding in 2025 (beyond a ₹75 crore emergency infusion from Reliance Retail) forced store closures, reducing presence from 19 cities to 3 by year-end. Dunzo’s CAC exceeded ₹850 while average order value remained ₹340, creating an unsustainable LTV/CAC ratio of 0.8x. The platform’s failure to differentiate beyond ‘speed’ meant that larger, better capitalized competitors (Blinkit, Zepto, Swiggy Instamart) simply out executed on operations while offering similar service levels. Dunzo’s pivot to B2B logistics showed some promise but came too late to offset consumer business losses. The company’s effective shutdown of consumer operations by Q4 2025 marked the end of one of India’s quick commerce pioneers.

D2C Disappointments

Sugar Cosmetics: Despite strong brand awareness and initial success, Sugar Cosmetics struggled in 2026 due to intensifying competition and margin pressures. The brand’s dependence on heavy discounting to compete with both international players (Maybelline, Nykaa private labels) and newer D2C entrants (Plum, Renee) eroded gross margins from 62% to 47%. Sugar’s customer acquisition costs increased 58% year-on year as Instagram and Facebook advertising reached saturation, while organic reach declined due to algorithm changes. The company’s retail expansion to 1,200+ points of sale created distribution breadth but generated insufficient foot traffic, with offline contributing only 28% of revenue despite representing 45% of operational expenses. Sugar’s product innovation slowed, launching only 12 new SKUs in 2025 compared to 40+ in previous years, allowing competitors to capture trend-driven demand. The brand’s repeat purchase rate declined to 34%, indicating weakening customer loyalty. Sugar’s inability to raise Series D funding at acceptable valuation ($180 million attempted, down from $350 million Series C in 2022) forced cost-cutting measures including 25% workforce reduction and closure of underperforming retail stores.

Licious: The premium meat delivery brand’s path to profitability remained elusive despite seven years of operation and $300+ million in funding. Licious’s cold chain infrastructure requirements created fixed cost burdens that prevented profitable scaling. The company operated 35 processing centres and 125 micro-fulfilment hubs, generating ₹650 crore in revenue but burning ₹180 crore annually. Licious’s average order value of ₹720 appeared healthy, but purchase frequency of 1.8 orders monthly (compared to grocery’s 4-5 monthly) limited customer lifetime value. The brand’s inability to expand beyond metro and tier-1 cities (which accounted for 94% of revenue) constrained growth, while within these markets, penetration stalled at 2.8% of households. Licious faced intensifying competition from both organized players (FreshToHome, Zappfresh) and traditional local butchers who improved hygiene standards and began accepting digital payments. The company’s premium positioning (prices 25-40% above traditional retail) resonated during COVID but lost appeal as consumers rationalized spending in 2024-25. Licious’s pivot to include plant-based meats and ready-to-cook meals showed minimal traction, contributing only 8% of revenue. The brand’s Series G funding round in mid-2025 raised only $35 million at a down valuation ($450 million, from $1.05 billion in 2022), necessitating market consolidation to seven cities and 35% workforce reduction.

Udaan: India’s B2B eCommerce unicorn faced existential challenges in 2026. Once valued at $3.2 billion (2021), Udaan’s valuation collapsed to under $800 million as the company struggled with unit economics and market fit. The platform’s attempt to connect small retailers with manufacturers and wholesalers encountered structural barriers: entrenched offline distribution networks, credit risk in small retailer segments, and high logistics costs in fragmented markets. Udaan’s GMV declined 23% year-over-year to $1.8 billion as the company tightened credit policies following bad debt write-offs exceeding ₹450 crore. The platform’s seller base contracted from 3 million to 1.8 million as inactive accounts were purged. Udaan’s inability to achieve contribution margin positivity despite seven years of operations raised questions about the viability of B2B marketplace models in India without captive supply or demand. The company’s cash burn of $150 million annually, combined with inability to raise follow-on funding, forced drastic downsizing including closure of non-core categories (fashion, general merchandise) to focus exclusively on FMCG and staples. Udaan’s challenges illustrated that B2B commerce transformation requires longer timelines and deeper integration with existing supply chains than initially anticipated.

Marketplace Challenges

Snapdeal: Once India’s third-largest eCommerce marketplace (valued at $6.5 billion in 2016), Snapdeal’s continued decline in 2026 demonstrated the difficulty of competing without continuous capital infusion. The platform’s GMV stagnated at $650 million, representing less than 1% market share. Snapdeal’s repositioning as a value-focused marketplace for Tier 2/3 cities failed to differentiate meaningfully from Flipkart’s budget platform Shopsy or Meesho’s zero-commission model. The company’s seller base declined to 120,000 (from 300,000 peak), as merchants prioritized larger platforms with superior customer traffic. Snapdeal’s marketing spend constraints limited visibility, with brand awareness in metros declining to 12%. The platform’s technology infrastructure, not updated significantly since 2019, created performance gaps compared to competitors’ AI-powered recommendation engines and personalized experiences. Snapdeal’s inability to establish a profitable niche—value positioning without Meesho’s social commerce differentiation, general marketplace without Amazon/Flipkart’s resources, left it stranded in strategic no-man’s land. The company’s pivot to focus exclusively on fashion and home categories represented an admission that competing across all categories was no longer viable.

Key Lessons from Failures

The brands that struggled in 2026 shared common characteristics that offer instructive lessons. First,

unit economics cannot be ignored indefinitely: Dunzo and Licious demonstrate that growth without path to profitability eventually encounters investor fatigue, regardless of market potential. Both companies achieved scale (millions of users, hundreds of crores in revenue) but failed to translate scale into sustainable economics.

Second,

differentiation must be defensible: Sugar Cosmetics and Snapdeal lost relevance when their initial differentiation (trendy products, value positioning) became replicable by better-resourced competitors. Sustainable competitive advantages

require ongoing investment in brand, technology, or supply chain that smaller players struggle to maintain.

Third,

market timing and capital efficiency matter critically: Udaan’s challenges stemmed partly from attempting B2B transformation before digital payment infrastructure and small retailer adoption reached critical mass. The company’s high burn rate during the market development phase depleted capital before achieving self-sustaining growth.

Finally,

operational excellence is non-negotiable: The quick commerce and D2C winners (Zepto, Blinkit, Mamaearth, BoAt) distinguished themselves through superior execution—faster fulfilment, better product quality, lower costs, rather than merely through positioning or marketing. Operational capabilities compound over time, creating widening gaps between leaders and laggards.

Technology Stack: AI as Infrastructure

AI-Powered Commerce Operations

Artificial intelligence has transitioned from experimental feature to fundamental infrastructure across the eCommerce stack. Major platforms report 18-25% conversion rate improvements from AI-powered personalization (platform disclosures, 2025-26), with recommendation engines driving 31% of total GMV. Beyond consumer-facing applications, AI optimization of inventory placement, dynamic pricing, and demand forecasting has reduced operational costs by 12-15% while improving in-stock rates.

Amazon India’s AI-driven inventory positioning system, which places products in fulfilment centres based on predicted demand geography, reduced delivery times by 18% while cutting logistics costs by ₹120 per order. Flipkart’s visual search and voice-based shopping interfaces, processing queries in 11 Indian languages, drove 22% of product discovery in 2026.

Conversational AI and vernacular language models have democratized customer service, with 67% of routine queries handled by AI agents across multiple Indian languages (industry estimates). The critical advancement is contextual understanding in Hinglish and code-mixed languages, enabling natural interactions that previously required human agents.

Read more here, How AI Agents Are Transforming Online Retail in 2026

Composable Commerce and Headless Architectures

The shift toward modular, API-first commerce architectures has reached a tipping point. As of 2025, 43% of mid-sized to large brands have implemented headless commerce solutions, enabling omnichannel experiences, faster feature deployment, and freedom from monolithic platform constraints.

What makes this transition particularly significant for India is the parallel emergence of locally built commerce tools. These homegrown platforms are reducing dependence on international SaaS providers while addressing distinctly Indian challenges, from integrating complex payment gateways to navigating intricate last-mile logistics and meeting stringent data localization requirements.

Building Strategic Moats Through Technology

Advanced tech stacks are creating measurable competitive advantages. API-first design facilitates infrastructure unbundling, allowing networks like ONDC to decouple discovery from fulfillment. AI-powered search and recommendation engines now drive 31% of purchases on major platforms. Meanwhile, headless architectures enable brands to seamlessly deploy vernacular interfaces, crucial when 42% of users prefer shopping in their native language. This flexibility also powers omnichannel agility, allowing retailers like Lenskart and Mamaearth to sync online data with thousands of physical touchpoints in real time.

The results speak for themselves. Flipkart leverages sophisticated AI-driven interfaces across 11 languages, accounting for 22% of product discovery. Lenskart’s AI-powered 3D try-on technology, easier to iterate in a headless environment—has slashed returns to just 3.2%.

The cost of inaction is equally clear. Snapdeal’s stagnant technology infrastructure, largely unchanged since 2019, created performance gaps that prevented the platform from delivering the AI-powered recommendations and personalized experiences that Indian consumers now expect.

The ONDC Advantage

The Open Network for Digital Commerce operates as a decentralized, microservices based network built on the open Beckn protocol, and composable architecture is uniquely positioned to unlock its potential.

ONDC unbundles the traditional eCommerce value chain into discrete components: discovery, transaction, and fulfilment. Composable stacks allow brands to integrate specialized buyer or seller modules via APIs without overhauling core systems. This plug-and-play modularity, combined with ONDC’s standardized APIs, ensures seamless interoperability between participants. When India Post joined ONDC as a Logistics Service Provider in January 2026, headless systems enabled sellers to dynamically book logistics partners with a single click—a practical demonstration of decoupled architecture in action.

Technical Imperatives for 2026

For mid-sized Indian brands, the focus has evolved from technology ownership to orchestration. Modern stacks prioritize three core capabilities:

- Headless CMS for centralized content distribution across WhatsApp, Instagram, and web apps—essential as social commerce now captures 28% of customer journeys.

- Unified digital identity, integrating protocols like Aadhaar Payments Network to verify transactions and reduce fraud.

- Modular subscription engines that power programs like Lenskart Gold, which manages millions of members and contributes to a customer lifetime value of ₹12,400.

Looking Ahead: 2026–2030

The democratization of commerce technology is accelerating. Sophisticated personalization and operational tools once exclusive to giants like Amazon are becoming accessible to smaller brands through affordable SaaS solutions. But as AI capabilities become table stakes, the competitive edge is shifting from simply having the technology to how brands leverage their data and design experiences within these modular systems.

The regulatory landscape is also reshaping technical requirements. New architectures must now natively support the Digital Personal Data Protection Act, requiring robust consent management and data localization frameworks. In this environment, adaptability isn’t just an advantage—it’s the foundation of survival.

Logistics Evolution: The Infrastructure Advantage

Logistics infrastructure has emerged as the defining competitive advantage in Indian eCommerce. The expansion of fulfilment centres to 1,200+ locations nationwide (industry data), combined with last-mile partnerships reaching 95% postal code coverage, has transformed delivery from constraint to capability.

The critical innovation is multi-tiered fulfilment strategies that balance speed, cost, and reliability. Leading platforms operate simultaneous networks: hyperlocal dark stores for 15-30 minute delivery in dense urban areas, regional fulfilment centres for same-day and next-day delivery, and national warehouses for long-tail inventory. This approach optimizes inventory allocation while maintaining service levels across diverse geographies.

Delhivery’s automated sortation centres, processing 2.5 million packages daily, reduced per-shipment handling costs by 32% while improving delivery accuracy to 98.7%. Ecom Express’s hyperlocal delivery network, covering 27,000+ pin codes, enabled same-day delivery for 62% of urban orders.

Returns logistics, historically a profitability challenge, has improved significantly with quality-check-at-source and instant refund processes reducing return rates by 8-12 percentage points in applicable categories (platform data). The integration of reverse logistics with forward logistics has reduced costs by 18% while improving customer satisfaction scores.

Economics of Profitability

The Customer Acquisition Cost Crisis

Customer acquisition costs have increased 32% since 2024, reaching ₹850-1,200 per acquired customer for horizontal marketplaces and ₹450-750 for focused verticals (industry benchmarks, 2025-26). This increase stems from platform advertising saturation, iOS privacy changes reducing targeting efficacy, and intensifying competition for digital attention.

The strategic response has been decisive shift toward retention economics. Profitable eCommerce companies demonstrate 55%+ repeat purchase rates within 90 days, with customer lifetime values exceeding 3.5x acquisition costs. Loyalty programs, subscription models, and content-driven community building have emerged as sustainable growth strategies compared to performance marketing dependency.

Unit Economics and Profitability Pathways

The path to profitability in Indian eCommerce has clarified considerably in 2026. Successful models share common characteristics: contribution margins exceeding 20%, repeat purchase rates above 50%, and disciplined capital allocation toward sustainable growth rather than market share acquisition at any cost.

Marketplace models demonstrate profitability at scale, with leading platforms achieving EBITDA positive operations through advertising revenue, fulfilment services, and financial product commissions that now collectively exceed 35% of revenue (public company filings, 2025). Flipkart’s advertising business crossed ₹2,400 crore in 2026, contributing 28% of total revenue with 70%+ margins. Amazon India’s fulfilment services (FBA) and advertising collectively generated $1.2 billion in high-margin revenue.

D2C brands reach profitability earlier through higher gross margins (55-70% versus marketplace 10-15%) but face customer acquisition challenges requiring sophisticated retention strategies. The breakeven point for successful D2C brands has standardized at ₹100-150 crore annual revenue, assuming 60%+ gross margins, 30%+ repeat rates, and CAC under ₹600. Here is our take on The Vanity vs Vital Signs.

Regulatory Landscape and Compliance

The regulatory environment for Indian eCommerce has matured significantly, with the Digital Personal Data Protection Act implementation requiring comprehensive consent management, data localization, and user rights frameworks. Compliance costs have increased 15-20% for major platforms (industry analysis), while creating barriers to entry that inadvertently advantage established players with resources for legal and technical implementation.

ONDC governance represents regulatory innovation, balancing open network principles with consumer protection and platform accountability. The evolving framework addresses price transparency, search neutrality, and dispute resolution, creating operational standards that may influence broader eCommerce regulation.

Cross-border eCommerce regulation has tightened, with customs duty rationalization and import compliance requirements increasing operational complexity for international sellers. However, this has simultaneously stimulated domestic manufacturing and brand development, with 68% of products sold online now featuring significant Indian value addition (Ministry of Commerce data, 2025).

Strategic Outlook: Playbook 2026-2030

Structural Trends That Will Compound

Several foundational trends demonstrate compounding momentum that will shape the next four years. Geographic expansion into Tier 3 and 4 cities will continue, with 180 million new internet users expected by 2028 (IAMAI projections), predominantly from smaller towns and rural areas. These users will access eCommerce primarily via vernacular interfaces and mobile-first experiences.

AI capabilities will become table stakes rather than differentiation, with smaller brands accessing sophisticated personalization, customer service, and operational optimization through affordable SaaS tools. The competitive advantage will shift from AI adoption to data quality, algorithmic refinement, and experience design.

Social and creator commerce will mature from experimental channel to core revenue driver, with 35-40% of digital-native brands deriving majority revenue from social platforms and creator partnerships by 2028. This requires fundamental operational changes around community management, content production, and creator relationship infrastructure.

What Will Likely Consolidate or Fail

Undifferentiated D2C brands lacking defensible competitive advantages will face severe pressure, with consolidation expected to reduce the D2C brand count by 30-40% through acquisitions, shutdowns, or pivot to marketplace-only models. Survival requires authentic brand differentiation, proven retention economics, or category leadership.

Vertical commerce platforms in commoditized categories will struggle against horizontal marketplace convenience and quick commerce speed. Success in vertical specialization requires genuine expertise, curated selection, or community benefits that justify foregoing marketplace breadth.

Traditional offline-first brands without credible digital strategies will lose market share acceleratingly, particularly as Gen Z and millennial consumers reach peak earning and spending years. The window for digital transformation is narrowing, with successful omnichannel integration requiring 18-24 months of sustained investment.

Playbooks

For D2C Brands and Emerging Companies

- Prioritize retention over acquisition from day one, designing products, services, and experiences that generate organic repurchase behaviour and customer lifetime value exceeding 3.5x CAC.

- Build hybrid distribution strategies combining owned channels with selective marketplace presence, avoiding exclusive dependence on any single channel while maintaining direct customer relationships.

- Invest in first-party data infrastructure and AI capabilities early, recognizing that competitive advantages in personalization and customer understanding compound over time.

- Develop authentic content and community strategies rather than treating social media as performance marketing channel, understanding that creator partnerships and user-generated content drive sustainable discovery and trust.

For Established Marketplaces and Platforms

- Accelerate Tier 2+ expansion through vernacular interfaces, local payment options, and partnerships with regional logistics providers, recognizing that next 100 million users drive multi-year growth.

- Develop merchant enablement services beyond basic listing capabilities, offering financing, growth tools, and operational support that increase seller success rates and platform stickiness.

- Balance efficiency optimization with experience quality, resisting temptation to over-optimize for short-term metrics at expense of customer satisfaction and long-term retention.

- Prepare for regulatory evolution through transparent operations, robust compliance frameworks, and constructive engagement with policymakers, recognizing that regulatory risk management is competitive advantage.

The Final Thought

The single biggest shift shaping Indian eCommerce in 2026 is the transition from growth at all costs to sustainable unit economics. After a decade of market share battles funded by venture capital, the industry is maturing into operational excellence, profitability focus, and genuine customer value creation.

The winners of 2026, Zepto, Blinkit, Mamaearth, BoAt, Meesho, Nykaa, share common characteristics: defensible competitive advantages, proven unit economics, operational excellence, and strategic discipline. The losers, Dunzo, Sugar Cosmetics, Licious, Udaan, Snapdeal, demonstrate the consequences of ignoring profitability, lacking differentiation, or mistiming market entry.

Why 2026 represents a tipping point rather than mere transition year becomes clear when examining convergent forces: technology democratization enabling sophisticated capabilities for mid-sized players, geographic expansion reaching critical mass in Tier 2+ cities, regulatory maturation providing operational clarity, and consumer behavioural evolution toward experience quality over price arbitrage.

The strategic imperative for all stakeholders, brands, platforms, investors, and policymakers, is recognizing that Indian eCommerce has entered its second phase. Success in this phase requires different capabilities than the first: operational excellence over growth velocity, retention economics over customer acquisition, profitability over market share, and authentic differentiation over category participation.

The opportunity remains extraordinary. With digital commerce penetration at 9.8% of total retail and 900 million internet users expected by 2028 (IAMAI projections), India’s eCommerce growth story extends decades into the future. The winners, however, will be those who build for sustainability rather than scale alone, who prioritize customer lifetime value over transaction volume, and who recognize that the infrastructure phase of Indian digital commerce is giving way to the experience economy phase.

For companies and investors willing to operate with patience, discipline, and genuine customer focus, the 2026-2030 period will create enormous value. For those clinging to 2015-2020 growth-at-all-costs playbooks, the next four years will prove clarifying. The case studies of this report, both successes and failures, provide roadmap for navigating India’s mature eCommerce landscape.

Research Methodology & Data Sources

Research Approach: This white paper synthesizes quantitative market data, qualitative industry interviews, regulatory analysis, and proprietary research conducted between November 2025 and January 2026. Market sizing and growth projections incorporate data from industry reports, public company filings, and aggregated transaction data from payment processors and logistics providers. Company specific performance analysis draws from public disclosures, investor presentations, media reports, and industry sources.

Primary Data Sources: Industry association reports from Internet and Mobile Association of India (IAMAI), eCommerce Council of India, Reserve Bank of India digital payment statistics, Ministry of Commerce trade data, National Payments Corporation of India (NPCI) UPI transaction reports, and analyst research from Bain & Company, RedSeer, and Redseer Consulting. Company-specific data sourced from public earnings calls, regulatory filings, investor presentations, and credible media reports.

Definitions: Gross Merchandise Value (GMV) represents total transaction value before returns and cancellations. Market penetration calculated as eCommerce GMV divided by total retail consumption expenditure. Tier classifications follow Census of India definitions: Tier 1 (population >4M), Tier 2 (1M-4M), Tier 3 (100K-1M), Tier 4 (<100K). Customer Acquisition Cost (CAC) represents fully-loaded cost to acquire transacting customer. Customer Lifetime Value (LTV) calculated as average gross margin per customer over 36-month period.

Limitations: Market sizing estimates incorporate publicly available data supplemented by industry surveys and analyst projections, which may contain methodological variations. Growth projections assume continuation of current regulatory frameworks and absence of major disruptive events. Company specific performance data represents publicly disclosed information or aggregated industry benchmarks rather than comprehensive audit. Valuations cited reflect most recent funding rounds or public market valuations and may not represent current fair value. Forward looking statements regarding company performance and market trends reflect analysis and reasonable assumptions but carry inherent uncertainty.

References

- Bain & Company. (2026). India eCommerce Evolution: The Next Decade. January 2026.

- Internet and Mobile Association of India (IAMAI). (2025). India Digital 2025 Report.

- Ministry of Commerce & Industry, Government of India. (2025). Open Network for Digital Commerce Impact Assessment. Q4 2025.

- Ministry of Electronics & Information Technology. (2023). Digital Personal Data Protection Act, 2023 – Implementation Guidelines.

- National Payments Corporation of India (NPCI). (2025). UPI Transaction Statistics Report. Q4 2025.

- RedSeer Consulting. (2025). Quick Commerce in India: Economics and Growth Trajectory. December 2025.

- Redseer Strategy Consultants. (2025). Vernacular Digital Consumer Behavior Study. 2025.

- Reserve Bank of India. (2025). Digital Payment Trends 2025-26. RBI Bulletin.

- Public company filings and investor presentations: Nykaa (FSN E-Commerce Ventures Ltd), Zomato Ltd, Honasa Consumer Ltd (Mamaearth), and other listed eCommerce entities (2025-26).

- Industry benchmarks and platform disclosures from leading eCommerce companies (2025-26).

- Media reports and industry analysis from Economic Times, Mint, TechCrunch India, Inc42, and YourStory (2025-26).